Group Health Insurance Renewals Are Coming Up - Are You Ready?

Are you Prepared for 2020?

Health insurance renewals will be right around the corner – are you prepared? Is your current benefits consultant doing all they can to ensure you and your employees are getting the most for your hard-earned premium dollars? The National Business Group on Health reports that health insurance premiums increased a minimum of 5% in 2019. This might not sound like much, but if you’re a small to mid-sized employer with 30 employees it could mean approximately a $15,000 annual increase just in 2019 – not to mention compounding upon that increase again in 2020. Can your organization or employees continue to absorb those costs year-over-year without carefully considering all your options?

Are You Leaving Money on the Table?

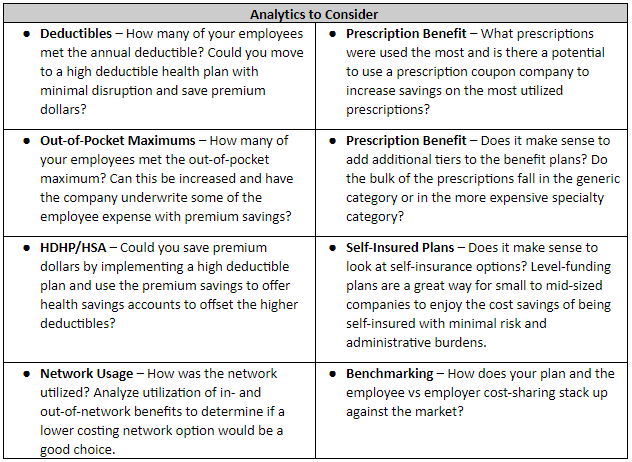

One of the most important pieces to consider when you review your plan designs is how are the benefits being utilized by your employees. What exactly does this mean? It means that generally the main drivers of cost in health insurance plans are the deductibles, co-pays, out-of-pocket maximums and prescription plans. Is your benefits consultant sitting down with you during renewal (ideally, it should be more frequent) to review how your employees utilized the benefits throughout the year or did they basically just shrug their shoulders and say, “that’s the health insurance market” and rubber stamp the renewal?

STOP! Before You Rubber Stamp

Before signing off on your renewal, we recommend that at a minimum you should discuss how the plan was utilized by your employees over the plan year. This information is important and can shed insight on where you can potentially make (big and small) plan adjustments, save premium dollars and keep your employees happy and healthy!

These are just a few of the benefit strategies you can consider during the benefit renewal process. Don’t just focus on your health insurance plans during renewals, but carefully consider the entire benefit package you offer to your employees – take a holistic approach. You might find that your entire benefit package strategy may support a lean health insurance plan by compensating with higher compensation or other benefits. Take a comprehensive and strategic approach to designing your compensation and benefit programs or you may be inadvertently leaving money on the table and spend more than you really need to.

Upcoming Benefit Trends

There are constantly new and exciting products being offered in the health insurance arena and the on-demand or virtual care seems to be an area employers are focusing on going forward. According to Kiplinger, one of the top health care initiatives for employers for 2020 will be increasing the virtual care solutions such as telehealth – virtual doctor’s visits for services such as sinus/upper respiratory, allergies and the flu type symptoms. Along with the telehealth options, they are looking to offer other virtual wellness type services for mental health, behavioral health, health and lifestyle coaching, weight management and diabetes. Oftentimes these additional plan options don’t come with a high price tag and may give you an opportunity to redesign your plan for additional savings in other areas.

This certainly isn’t a comprehensive list, but simply a glimpse of what is available for savvy employers without breaking the bank. Be sure to work closely with your benefits consultant to ensure they fully understand your total rewards (compensation, benefits, work-life effectiveness, performance management, talent development and recognition) package to ensure you are utilizing all your financial resources effectively.

Marketing 101: Selling Your Benefits

Business owners fully understand that it’s cheaper and easier to keep clients than it is to go out and find new ones. In order to keep their services foremost in their client’s mind, they continually market and sell their value proposition. This same philosophy should hold true with employees – it’s easier and less expensive to keep the good ones as opposed to starting over. With the cost of turnover running approximately 30% of the employee’s annual wage, employers should do all they can to keep their employees engaged. Continually selling how much they are investing in their employees from a benefits (total rewards) perspective is a great start.

Employees value benefits most when they really understand what they are getting, and that value message is continually being reinforced. Your benefits consultant can help you build communication strategies including content and schedule to continually demonstrate the value of your total rewards packages. In seeking to provide as much detail and transparency as possible, your communication strategies should cross all types of communication channels such as: onsite meetings, webinars, text messages, compensation statements, and email campaigns. Don’t be shy to share all the great things you are providing your employees – they will come to appreciate all the communication and feel valued!

Advantages of Working with a Key Elements Benefits Consultant

Key Elements Consulting’s Benefits Consultants will work closely with our clients to ensure we fully understand you! We want to understand your strategic vision of the future, your current business environment, what’s important to you and your employees, along with your current total rewards packages. Once we have this valuable information, we can work closely with you to ensure you are providing your employees with benefit packages that provide the best value across the board.

States Where We Provide Benefit Consulting Services

We provide onsite and/or virtual benefit consulting services for our clients located in Iowa, Minnesota, Missouri, Illinois, Nebraska and South Dakota.

To learn more about how a benefits consultant from Key Elements Consulting can help you create total benefits package that makes sense and the most of your financial resources, contact Kim Peterson at 515-669-1528 or email at Kim@KeyElementsConsulting.com.

Click here to see everything you get by working with us as your benefits consultant!