Are You Ready for Group Health Insurance Renewal?

Health insurance renewals will be right around the corner – are you prepared? Is your current benefits consultant doing all they can to ensure you and your employees are getting the most for your hard-earned premium dollars?

Are You Leaving Money on the Table?

Generally, the key drivers of cost in the design of health insurance plans are deductibles, co-pays, out-of-pocket maximums and prescription plans. So understanding how your employees are using each of these key drivers throughout the year is going to be a critical piece of your renewal strategy. For example, you may find that the majority of your employee population aren’t meeting their annual deductibles, but are heavily utilizing office co-pays. Using this information, you may be able to increase the deductible amounts with minimal disruption resulting in lower premiums you pay as an employer. You could then use the dollars you saved to either purchase a lower co-pay plan which your employees actually utilize or purchase additional benefits. There’s several different strategies employers and their benefit consultants can use, but it really takes understanding how employees are using the benefits you provide. Bottom line, make sure you aren’t leaving benefit dollars on the table and ask your benefits consultant to review these analytics with you.

STOP! Before You Rubber Stamp Your Renewal

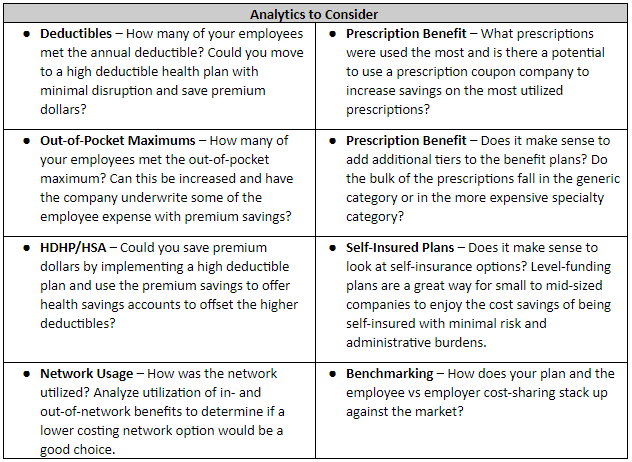

Before signing off on your renewal, we recommend at a minimum you discuss how the plan was utilized by your employees over the plan year. The table below outlines some key plan analytics to consider when determining your benefits strategy. This information provides insight on where you can potentially make (big and small) plan adjustments, save premium dollars and keep your employees happy and healthy!

These are just a few of the benefit strategies you can consider during the benefit renewal process. However, don’t just focus on your health insurance plans, but carefully consider the entire package you offer to your employees – take a holistic approach. You might find that your particular total rewards package strategy may support a lean health insurance plan by balancing with higher compensation or other benefits. Take a comprehensive and strategic approach to designing your total rewards programs or you may be inadvertently leaving money on the table and spend more than you really need to.

Virtual Workplace Considerations

When it comes to a virtual workplace, technology isn’t the only thing employers and employees need to take into consideration. As employers are able to hire from a more diverse geographic region given the ability to work virtually, there’s ripple effects that need to be taken into account. The ability to be mobile is a great benefit; however, employers need to ask - how does that impact the insurance coverage we offer? What if an employee needs medical care while traveling or if they are based quite a ways away from where our plan currently assumes employees are located? How will insurance process the claims? The short answer - it depends.

Coverage will depend on many factors such as your policy, plan design and the available provider networks. For instance, some plans have guest memberships that you can get if you’re going to be traveling or residing in other states for more than 90 consecutive days. Some PPO networks provide coverage all across the country. Either way, before your employees grab their laptop, charger and hit the road, or you broaden your recruitment map check in with your insurance company or agent to see how your plan can be designed to provide coverage to all your employees. There’s a big cost sharing difference for employees for claims processed in network vs out-of-network.

Upcoming Benefit Trends

There are constantly new and exciting products being offered in the health insurance arena and on-demand or virtual care seems to be an area employers will continue to focus on. Going forward, many small to mid-sized employers who generally cover 65% to 75% of employee premiums will be faced with the difficult task of keeping benefit plans affordable. Some of the upcoming trends for small to mid-sized employers driven by the continually rising cost of healthcare could look like:

Higher deductible health plans with employers using creative strategies such as HSAs and FSAs to offset the high deductibles and copays for employees.

With a focus on equity, some employers will be offering banded premiums which covers a larger portion of the premiums for lower paid employees.

Plans to provide more virtual care options for wellness type services for mental health, behavioral health, health and lifestyle coaching, weight management and chronic conditions like diabetes.

Providing employees with tools to become better consumers in the healthcare space. These tools range from pricing services from different healthcare providers to online decision making tools for surgical procedures.

Employers ensuring their health insurance plan designs can accommodate a virtual (or mobile) workforce without employees incurring expensive out-of-network costs for services. This may be especially appealing in attracting and retaining employees who like the idea of working from exciting new locations, simply aren’t interested in relocating for a new company or perhaps want to move back home closer to their family.

This certainly isn’t a comprehensive list, but simply a glimpse of what is available for savvy employers without breaking the bank. Be sure to work closely with your benefits consultant to ensure they fully understand your total rewards (compensation, benefits, work-life effectiveness, performance management, talent development and recognition) package to ensure you are utilizing all your financial resources effectively.

Benefits’ Role in Employee Recruitment & Retention

The same way you build and sell your value proposition to your current or potential clients, the value proposition you market to your employees can be just as critical. Employees value the benefits from their employer most when they really understand what they are getting. Since you have (hopefully) brought in employee needs and perspectives into designing the benefits package you offer, don’t be shy to share all the great things you are providing – they will appreciate all the communication and feel valued! Design communication strategies that highlight the what, the why and the value of what you include in your total rewards package to entice new employees to join and good employees to stay.

As you build out your communication game plan, your deployment strategies should cross all types of communication channels such as:

Onsite group meetings or townhalls

Webinars or virtual events to announce changes, offerings and options

Text message and email campaigns

Compensation statements that can detail the financial investment in each individual employee

Intranet sites and Human Capital Management systems where benefit enrollment occurs

Advantages of Working with a Key Elements Benefits Consultant

Key Elements Consulting’s benefits consultants work closely with our clients to ensure we fully understand you! We want to understand your strategic vision of the future, your current business environment, what’s important to you and your employees, along with your current total rewards packages. Once we have this valuable information, we can work with you to ensure you are providing your employees with benefit packages that provide the best value across the board.

States Where We Provide Benefit Consulting Services

We provide benefit consulting services for our clients located in Iowa, Minnesota, Missouri, Illinois, Nebraska and South Dakota.

To learn more about how a benefits consultant from Key Elements Consulting can help you create a total benefits package that makes sense and the most of your financial resources, contact us today for a free consultation.